A Biased View of Redbud Advisors, Llc

Wiki Article

The Basic Principles Of Redbud Advisors, Llc

Table of ContentsHow Redbud Advisors, Llc can Save You Time, Stress, and Money.Get This Report on Redbud Advisors, LlcLittle Known Facts About Redbud Advisors, Llc.Some Ideas on Redbud Advisors, Llc You Should KnowGetting The Redbud Advisors, Llc To Work

Sometimes you may tackle the role of partner initially, then be advertised to supervisor - Oklahoma Cannabis Compliance. Ultimately, after 5 years or more and depending upon the company you benefit, you may have the possibility to relocate up to supervisor or partner level. Sector Working on the exact same timelines as in technique, sector accountants will start in the function of accounts aideThroughout the last phase of credentials, people can come to be economic experts. After concerning 3 years of being certified, industry accountants might relocate right into the duty of monetary accounting professional and continue to see their income rise.

Is it range, people, or your day-to-day work-life equilibrium? Don't forget that you can transform your mind, although it must be noted that moving from technique into industry is a lot simpler than the other means around.

Redbud Advisors, Llc - Questions

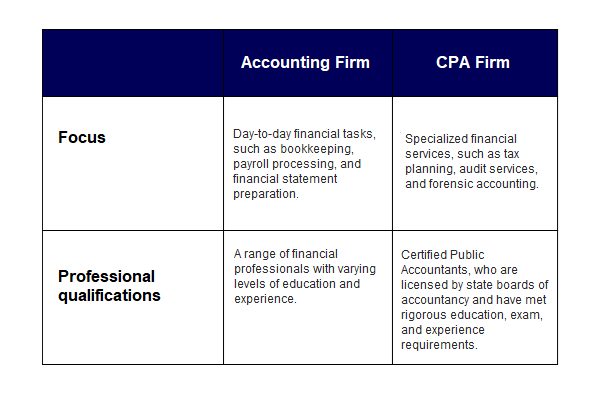

First of all, CPAs investigate financial records for compliance and additionally examine firm's monetary standing to guarantee there are no disparities. This is something that an accounting professional can not do considering that bookkeeping is an ability which can be acquired by accountants just by acquiring a certified public accountant permit. Along with bookkeeping, their oversight is necessary for budget plan and financial reforms.

Indicators on Redbud Advisors, Llc You Should Know

One of the most essential components of a CPA's job is to work with tax obligation returns and analyze financial info to make certain taxes are paid on time. Once once again, bookkeeping plays a crucial function in a Certified public accountant's work.A CPA can recommend, an accountant can act on that guidance. And thus CPA's recommendations administration on tax ramifications of organization choices.

CPA company leaders are the secret to the growth of the company, treatment of the team, and distribution of cutting-edge services to clients. As a company grows, firm leaders' duties can end up being exhausted and out of equilibrium.

Redbud Advisors, Llc Things To Know Before You Get This

They are in charge of the vision and observing the markets that the firm offers. This requires time so they need assistance to run their company properly when they grow. As the firm ranges larger, then there are even more people to take care of, and possibly more complex offerings being provided to a lot more intricate customers.

Firm proprietors may do many points such as stay the technical lead on all tax obligation and audit job, manage the movement of marketing tasks, site link and help an administrative specialist in handling the operations and rates of the firm. While these are very important features of the firm, the same proprietor(s) can't do them all as the company ends up being bigger.

The 20-Second Trick For Redbud Advisors, Llc

It's that point when certified public accountant firm leaders can produce a brand-new role, such as a Technical Testimonial Manager, and move all technological review of tax obligation and audit to a brand-new person from the team. This is called a promo and is meant to eliminate the owner of that section of their job so they can concentrate on the work of expanding the firm and caring for the group.Where the proprietor did numerous, many things to maintain the company going, this brand-new Technical Review Manager is liable for a specific part of what the proprietor made use of to do reviewing and managing the top quality of the technological tax and audit interactions. https://dreull-thoirds-symbueys.yolasite.com/. As proprietors split off their duties to employee with new functions, the management ends up being more certain in their job

The firm is profited over time with a greater top quality of technical testimonial considering that the role is now concentrated. This scenario plays out over and over as the proprietor continuously sheds certain duties of firm management to other solid, skilled employee on the group. Obviously, the company proprietor might employ someone from outside the firm to do these even more specific management tasks, yet it is much harder to bring in a leader to symbolize the society and stand for the proprietor to the group.

Report this wiki page